Developer Portal

Maximize the value of your tax credits with TTC Exchange

Take advantage of transferable credits, without wasting your time. Partner with TTC Exchange today

Welcome to TTC Exchange, the leading experts in clean energy finance and strategic partners for project developers. With an impressive track record of leading clean energy finance transactions, our team brings invaluable experience to the table. We specialize in structuring deals that maximize economic returns and minimize risks, ensuring the success and profitability of your projects.

Unrivaled Expertise in Clean Energy Financing

TTC Exchange brings decades of experience and expertise in clean energy financing, including tax advisory, credit valuation, and efficient financing solutions. As pioneers in the industry, we understand the complexities and nuances of clean energy projects, allowing us to offer unparalleled guidance and support to developers throughout their journey

Tailored Solutions for Every Project

We recognize that each clean energy project is unique, and our approach reflects this understanding. TTC Exchange delivers personalized solutions that meet the specific needs of developers, maximizing their chances of obtaining efficient and optimal financing. Our commitment to transparency ensures developers have full visibility into the process, empowering them to make well-informed decisions.

Simplified & Accelerated Transactions

TTC Exchange revolutionizes clean energy project financing, providing a simpler, faster, and more accessible alternative to traditional tax equity methods. By leveraging our streamlined processes and extensive network of investors, developers can secure competitive pricing for their tax credits and maximize their project returns with confidence.

Empowering Clean Energy Developers.

Unlock the Maximum Base and Bonus Credits for US Projects. Together, we drive sustainable impact

FOCUS AREAS

Investment Tax Credit (ITC)

Production Tax Credit (PTC)

Domestic Content Adder

Low Income Community Adder

Energy Community Adder

GEOGRAPHY

Projects located within the United States

-

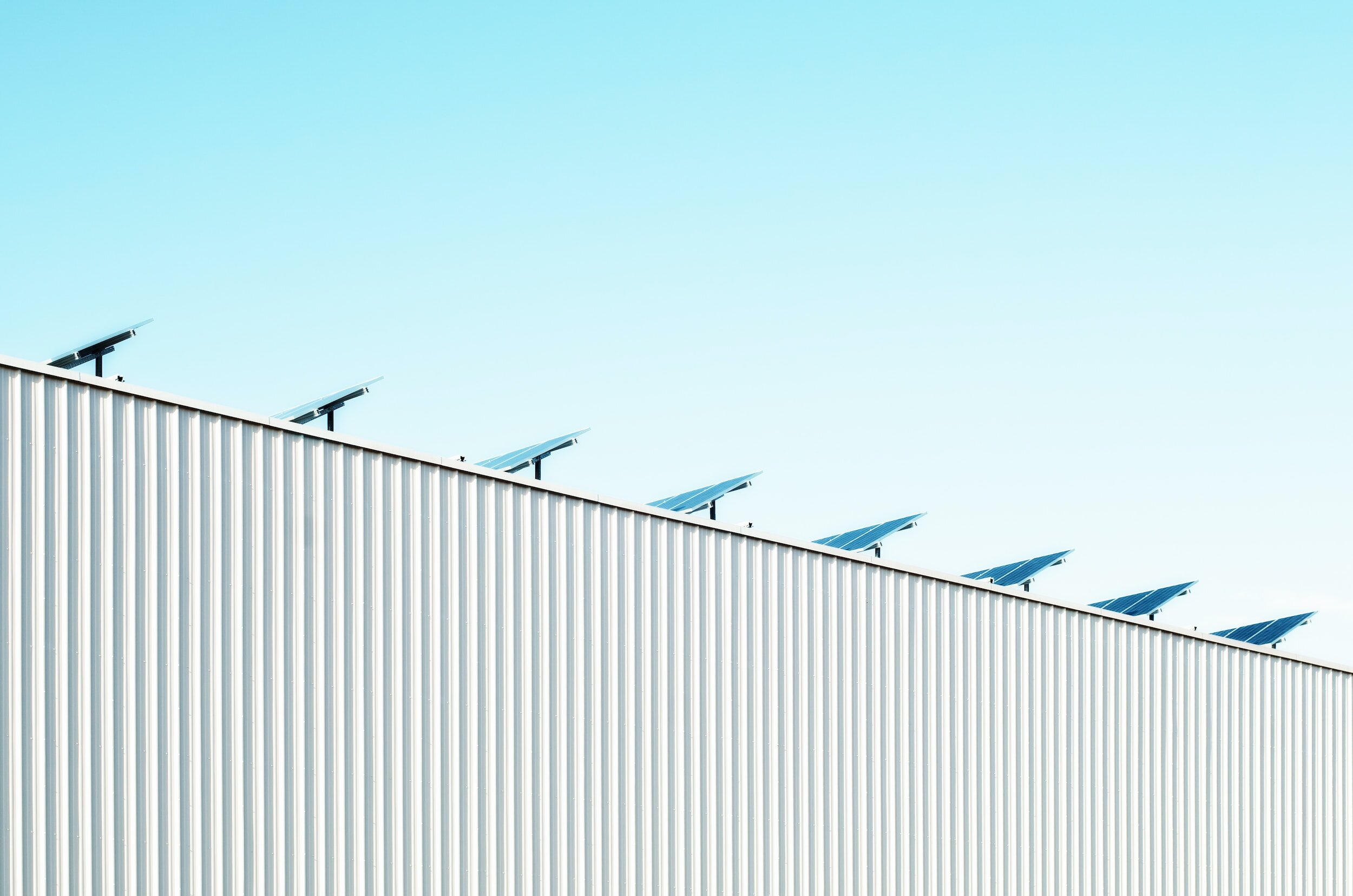

Solar

The Solar Energy Credit (48), (Form 3468, Part VI) promotes solar energy adoption by offering tax incentives to individuals and businesses that invest in solar energy property for electricity generation or illumination. By harnessing the power of the sun, taxpayers contribute to cleaner energy production, reduced carbon emissions, and increased energy independence. This credit supports the growth of solar technologies, driving innovation and sustainability in the renewable energy sector.

-

Wind

The Wind Energy Credit (48), (Form 3468, Part VI) incentivizes investment in wind energy projects, offering tax benefits to businesses and individuals who harness the power of wind to generate electricity. By qualifying for this credit, taxpayers contribute to clean energy production, reduce reliance on fossil fuels, and combat climate change. Wind energy remains a pivotal player in the transition to sustainable power sources, and this credit encourages continued growth in the wind sector.

-

Energy Storage

The Energy Storage Technology Credit (48), (Form 3468, Part VI) encourages investments in advanced energy storage systems. Taxpayers can claim this credit for property that receives, stores, and delivers energy for conversion to electricity or stores energy in the case of hydrogen. By utilizing energy storage technology, businesses and individuals enhance the reliability and efficiency of renewable energy integration while reducing reliance on traditional power sources.

-

Biogas

The Biogas Energy Credit (45Z) incentivizes the production of biogas from organic waste materials, providing tax benefits to those who invest in biogas facilities. Biogas is a renewable energy source generated through the anaerobic decomposition of organic matter, making it an environmentally friendly alternative to fossil fuels. By supporting biogas projects, taxpayers contribute to sustainable waste management practices and promote cleaner energy production while reducing greenhouse gas emissions.

-

EV Charging

The EV charging station infrastructure race offers numerous opportunities for filing with the Credit for Alternative Fuel Vehicle Refueling/Recharging Property (30C), Part 8911, Part II, and leveraging transferable tax credits (TTCs). By utilizing TTCs, eligible entities can expedite financing and rapidly scale their charging station projects. Seize this chance to contribute to sustainable transportation, benefit from tax incentives, and shape a cleaner, greener future while unlocking new avenues for rapid growth and success.

-

CCUs

The carbon capture usage and storage (CCU) industry is witnessing remarkable growth, offering a wealth of opportunities for businesses seeking to make a significant impact on carbon emissions. Through the Carbon Oxide Sequestration Credit (45Q), (Form 8933), companies can harness transferable tax credits (TTCs) to expedite financing and rapidly scale their CCU projects. Embrace this chance to be at the forefront of combating climate change, while benefiting from tax incentives that fuel innovation and sustainability. By participating in 45Q and utilizing TTCs, you can play a vital role in reducing carbon footprints, securing a cleaner future, and achieving exceptional growth in the evolving landscape of carbon capture usage and storage.

Developer FAQ

Featuring the latest guidance directly from the IRS.

More information can be found here

-

A. A taxpayer eligible to transfer credits is one that is NOT an applicable entity. See Q1-Q8 on "Elective Pay Eligibility" for information about applicable entities. Generally, an applicable entity would include a tax-exempt organization, a State or political subdivision, a local government, an Indian tribal government, an Alaska Native Corporation, the Tennessee Valley Authority, a rural electric co-op, a U.S. territory, or an agency or instrumentality of a state, local, tribal, or territorial government.

-

A. Any taxpayer that is NOT an applicable entity as listed in Q1 can elect to transfer (sell) all or a portion of the following "eligible credits."

Energy Credit (48), (Form 3468, Part VI)

Clean Electricity Investment Credit (48E), (Form 3468, Part V)

Renewable Electricity Production Credit (45), (Form 8835, Part II)

Clean Electricity Production Credit (45Y),

Zero-emission Nuclear Power Production Credit (45U), (Form 7213, Part II)

Advanced Manufacturing Production Credit (45X), (Form 7207)

Clean Hydrogen Production Credit (45V), (Form 7210)

Clean Fuel Production Credit (45Z)

Carbon Oxide Sequestration Credit (45Q), (Form 8933)

Credit for Alternative Fuel Vehicle Refueling/Recharging Property (30C), (Part 8911, Part II)

Qualified Advanced Energy Project Credit (48C), (Form 3468, Part III)

The amount of eligible credits a taxpayer can transfer can be affected by bonus or other requirements that may apply (including the Prevailing Wage and Apprenticeship Requirements, Domestic Content Bonus, the Energy Communities Bonus, and the Low-Income Communities Bonus).

-

A. While a taxpayer can transfer a portion of an eligible credit, a taxpayer cannot transfer a portion of an eligible credit related solely to a bonus credit amount. For example, the portion of an eligible tax credit related to the Domestic Context Bonus cannot be transferred separately from the rest of the eligible tax credit.

-

A. There are several steps for transferring eligible credits (or a portion of a credit). Not all steps need to occur in the order displayed below.

Pursue an eligible project. Identify and pursue a project that generates one of the eligible credits.

Complete electronic pre-filing registration with the IRS. This will include providing information about the taxpayer, the intended eligible credits, and the eligible credit project. Upon completing this process, the IRS will provide a registration number for each eligible credit property.

Complete pre-filing in sufficient time to have a valid registration number at the time you file your tax return.

More information about this pre-filing registration process will be available by late 2023.

Satisfy all requirements necessary to earn the eligible credit for the tax year. For example, a solar energy project would need to be placed in service prior to earning an eligible credit.

Arrange to transfer an eligible tax credit to an unrelated party in exchange for only cash.

Provide the transferee (i.e., buyer) with the registration number and all other information necessary to claim the transferred eligible credit.

Complete a transfer election statement with the transferee (as described in Q6 below).

File a tax return. File a tax return for the taxable year in which the eligible tax credit is determined indicating the eligible credit has been transferred to a third party and include the transfer election statement and other information as required by guidance. The tax return must include the registration number for the relevant eligible credit property and must be filed no later than the due date (including extensions) for such tax return.

If applicable, renew pre-filing registrations and file returns for each subsequent year that a transfer election is made to transfer an eligible credit related to the eligible credit property.

-

A. To claim transferred credits.

Arrange to purchase an eligible credit from an unrelated party in exchange for only cash.

Obtain from the transferor the registration number of the eligible credit property generating the eligible credit and all other information necessary to claim the eligible credit transferred.

Complete a transfer election statement with the transferor (as described in Q6 below).

File a tax return. File a tax return for the taxable year in which the eligible credit is taken into account by you under the rules of section 6418 and include the transfer election statement and other information as required by guidance. The tax return must include the registration number for the relevant eligible credit property.

-

A. The form and substance of a transfer election statement is as described in the guidance and generally includes the following. name, address and taxpayer identification number for both the transferor and transferee, a description of the type and amount of the eligible tax credit transferred, the timing and amount of cash paid for the eligible tax credit transferred and the registration number related to the eligible credit property. The transfer election statement should also include certain statements and/or representations from the transferor and transferee as described in the guidance. The transfer election statement should be attached to the transferor's tax return for the year in which the transferor becomes entitled to the eligible credit. The transfer election statement should be attached to the transferee's tax return for the year in which the transferee takes the eligible credit into account.

-

A. Eligible taxpayers may transfer all or a portion of an eligible credit generated from a single eligible credit property. They may also sell an eligible credit generated from a single eligible credit property to multiple unrelated parties in the same tax year.

-

A. No. You will provide the same registration number to all transferees of an eligible tax credit generated by the same eligible credit property.

-

A. Yes. A transferee taxpayer may take into account a credit that it has purchased, or intends to purchase, when calculating its estimated tax payments, though the transferee taxpayer remains liable for any additions to tax in accordance with sections 6654 and 6655 to the extent the transferee taxpayer has an underpayment of estimated tax

Go-to guide for developers to better understand transferable tax credits.